Purplevine IP published an article entitled "Chinese Companies Face Rising Global PAE Risks" in Patent Attorney Magazine.

Chinese Companies Facing Rising Global PAE Risk

Patent Assertion Entities (PAEs) are companies whose business model is to acquire patents and assert them against companies which generate revenue from making or selling products utilizing such patents (“operating companies”). For years now, PAEs have been troubling operating companies through lawsuits or demanding royalties by other means. What makes PAEs particularly frustrating for operating companies is that on the one hand, operating companies cannot fight back with their own patents because PAEs do not make or sell products, and on the other hand, the quality of the patents that PAEs assert are often very low. Recently, PAEs have received growing investment from venture capital firms and angel investors as a “good business” which has only made the problem grow on a global scale.

To understand the trend and efficiently assist Chinese companies to efficiently deal with PAEs, Purplevine IP Group (“Purplevine” or “we”) has analyzed litigation cases between Chinese companies and PAEs in the U.S., Europe and Chinese Mainland based on the data provided by Darts-IP. We noticed that Chinese companies have increased exposure to PAE litigation in these all three of these regions.

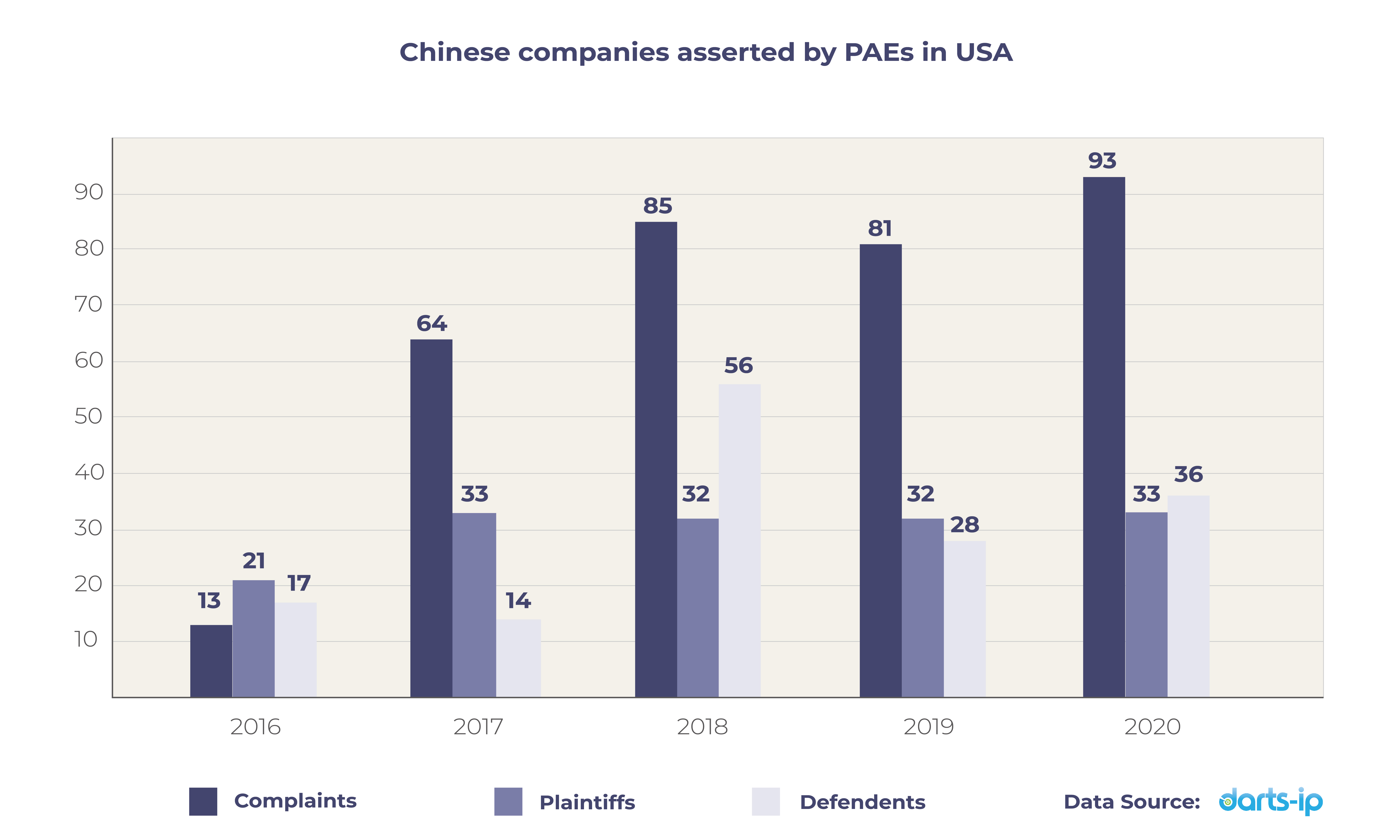

Chart 1 shows the number of Chinese companies sued by PAEs in the U.S. by year. The number of PAEs filing complaints against Chinese companies (including companies in Chinese Mainland, Taiwan and Hong Kong) jumped significantly from 2016 to 2017, and then has been increasing to a record number in 2020 in the U.S. In addition, the number of ITC complaints keeps increasing from 2016 to 2020. Several 337 investigations targeted on quite a few Chinese companies in 2018, so the number of asserted Chinese companies appears a peak in that year. There was a total of 96 unique Chinese companies asserted by PAEs from 2016 to 2020 (i.e. if affiliates of the same Chinese companies were sued by PAEs, those affiliates would be counted only as a single entity).

Chart 1

Innovation is a continuous process starting with product innovation focusing on scientific research and development and following by industry innovation focusing on manufacturing and marketing. US companies are well-known for R&D at product innovation. In contrast, Chinese companies have huge advantages in industry innovation with effective cost control and production process. It is an irresistible trend that Chinese companies will penetrate more product fields with growing market share in the U.S. Consequently, they will attract the attention of the PAEs with more litigations or patent enforcement actions. However, Chinese companies face additional sources of risk that US companies may not face from PAEs: Chinese companies can also be sued by PAEs in the International Trade Commission (ITC) for importing products into the US.

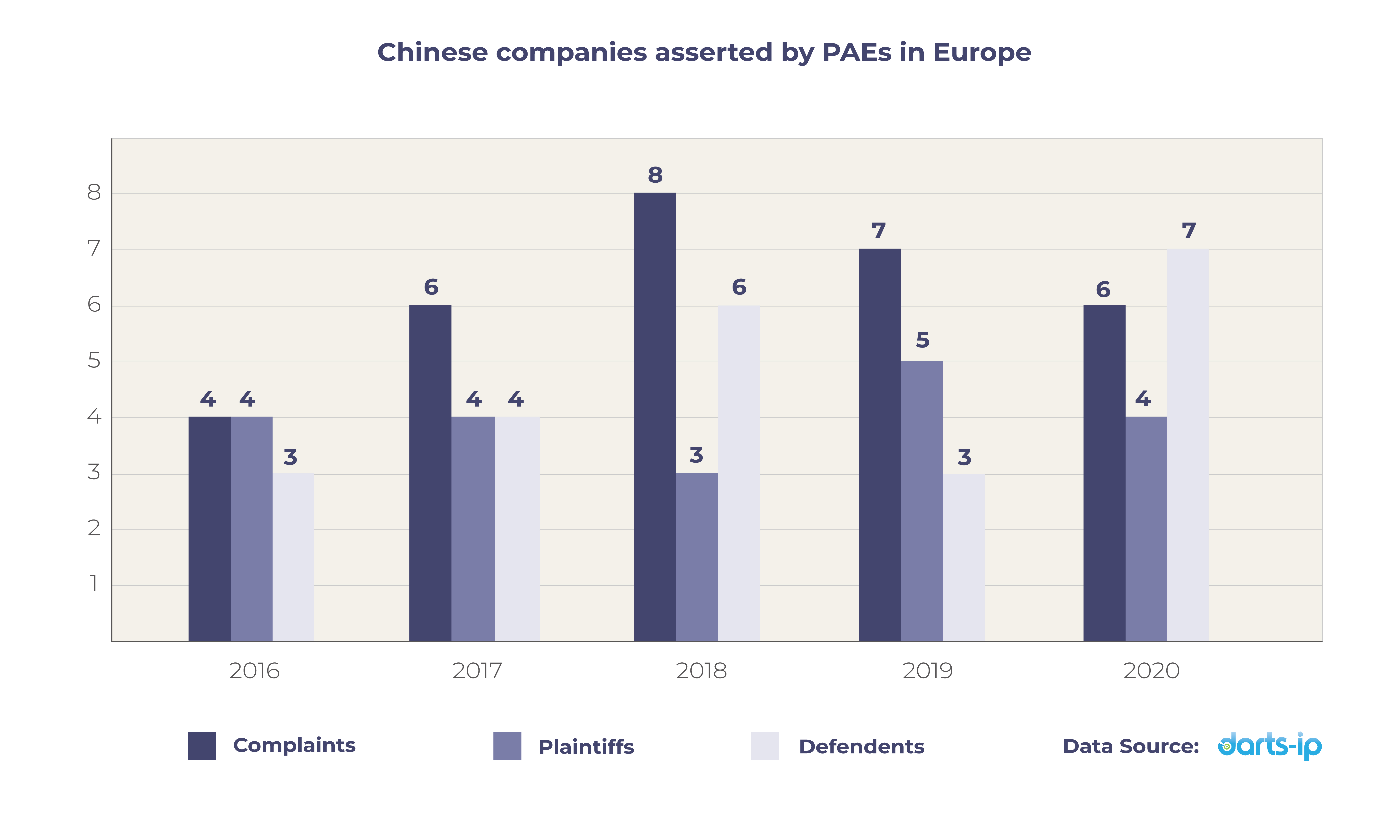

Chart 2 shows the number of Chinese companies sued by PAEs in Europe. Although the total amount of PAE activity in Europe is lower, the number of litigation also increases over time in Europe. In total, 15 unique Chinese companies were sued by 13 different PAEs from 2016 to 2020. Those PAEs filed litigation in seven different countries, including Germany, UK, France, Italy, Holland, Spain and Romania.

Chart 2

Despite the relatively low number of complaints filed, Chinese companies may still experience significant disruption in business in some countries in Europe where the courts could rule in favor of PAEs because in Europe a court’s award for a PAE can include injunctive relief in addition to an award of damages. PAEs have been able to get injunction orders easily in German courts. German Parliament adopted an Amendment to Patent Act in June 2021. Under the new legislation, courts examining a patent claim will conduct a proportionality test to decide whether an injunction would cause “undue hardship” to the alleged infringer or any third party. Since such proportionality test would require several cases to form a clear guideline, the impact on PAE's enforcement actions remains to be seen. In August 2020, PAEs were strongly supported by the UK Supreme Court in both global licensing rate and injunction orders against Huawei and ZTE two Chinese companies.

Europe has fewer PAE litigation cases in comparison with the U.S. in part due to limited market size and damage exposure Chinese companies have in the European countries. However, the UK supreme court landmark decision in Unwired Planet v Huawei case may inspire PAEs to file more litigations in the UK. For some reasons, some Chinese companies may explore the European markets before exploring the US markets. They may need to reconsider their market plan in Europe now.

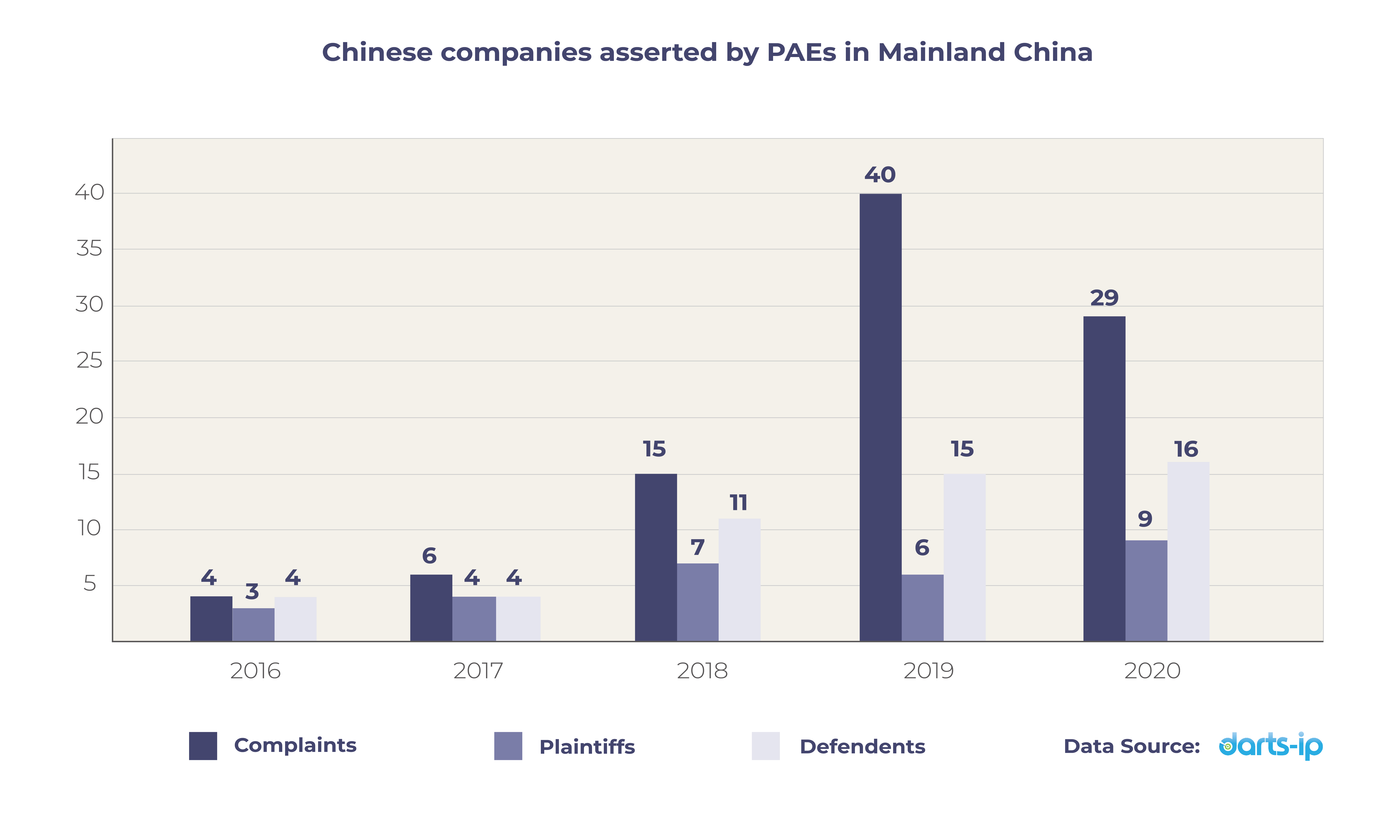

Chart 3 shows the number of Chinese companies attacked by PAEs in Chinese Mainland. Despite some criticism of insufficient protection for intellectual property right in China, the number of PAE complaints increases dramatically from 2016 to 2020. Foreign PAEs are the majority of the 20 different PAEs asserting from 2016 to 2020. The number of companies asserted by PAEs quadruples from 2016 to 2020, and there are 25 unique Chinese companies that have been asserted by PAEs from 2016 to 2020. PAEs filed litigation in seven different cities in China, including Beijing, Shanghai, Shenzhen, Nanjing, Hangzhou, Xian and Wuhan.

Chart 3

A US-based PAE sued a Chinese company in a Chinese Intermediate court for patent infringement using six patents in 2018. A year later, the parties resolved the case and the cost of the settlement was reportedly high. The cost of litigation in China is much lower than in the United States, so it could be attractive to PAEs who are planning litigations. In addition, the Chinese market size is negligible, so a large amount of license payment is expected for a large amount of product shipment. Both Chinese companies and foreign companies have been the litigation targets of PAEs in China and PAEs are likely to continue as long as they have patents at their disposal and see successful enforcement returns.

With the fast global business development, Chinese companies may encounter more serious PAE issues. As Chinese companies develop a global business strategy, they need to develop a global IP strategy that enables and protects that business.

Purplevine has abundant experience in assisting Chinese companies to fight against PAEs. It offers multiple defense weapons for the clients, including aggressive defense in the court proceedings, invalidity actions, effective negotiations, filing counter-claim or antitrust action in China, proactive searching and acquisition of potential targeting patents, and recommends Chinese companies participate in LOT Network.

Depending on the size and goal of clients, the first three actions could be effective but costly when the PAE approaches a company. The more cost effective solution is to take a proactive approach being used already by many of some of the largest Chinese companies already like Alibaba, Tencent, Xiaomi, DJI, Geely, etc. and that is to immunize the company to patents before they fall into the hands of the PAEs. This is why LOT Network is by far the most cost-effective solution for Chinese companies to mitigate the PAE risk.

It is known that almost 80% of PAEs litigated patents are acquired from operating companies. To address this root cause of the PAE issue, operating companies across the global have created a nonprofit community where every member agrees to grant other members a non-exclusive, conditional license if any of their patent assets are ever transferred to a PAE. In this way, LOT Network members may obtain free licenses to all the 3.1 million+ patent assets in LOT Network should they be acquired by PAE in anywhere the world in the future. The community has grown dramatically from the original 11 members in 2014 to now more than 1600 members in June 2021.

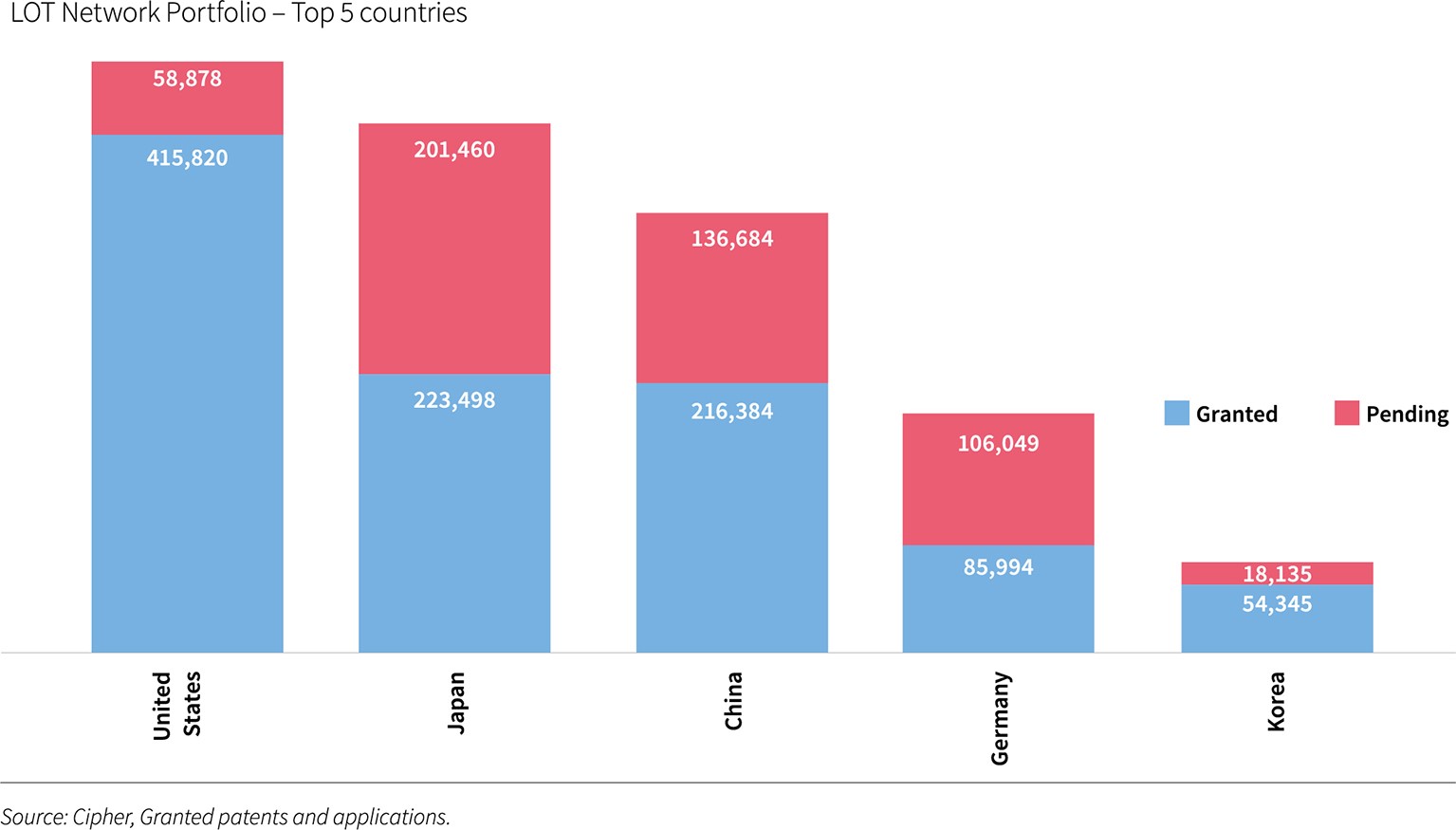

Chart 4 is from LOT Network Report 2020 and it shows LOT Network Portfolio in the top 5 countries. With its rapid membership growth, LOT Network has aggregated over 3,146,606 active worldwide assets subject to the LOT Agreement. The LOT Network Portfolio has the greatest coverage in the USA (28%), followed by China (24%) and Europe (14%). Members who have products sold in the USA, Europe and China may benefit from LOT Network’s good portfolio coverage in these regions to reduce the PAE risk.

Chart 4

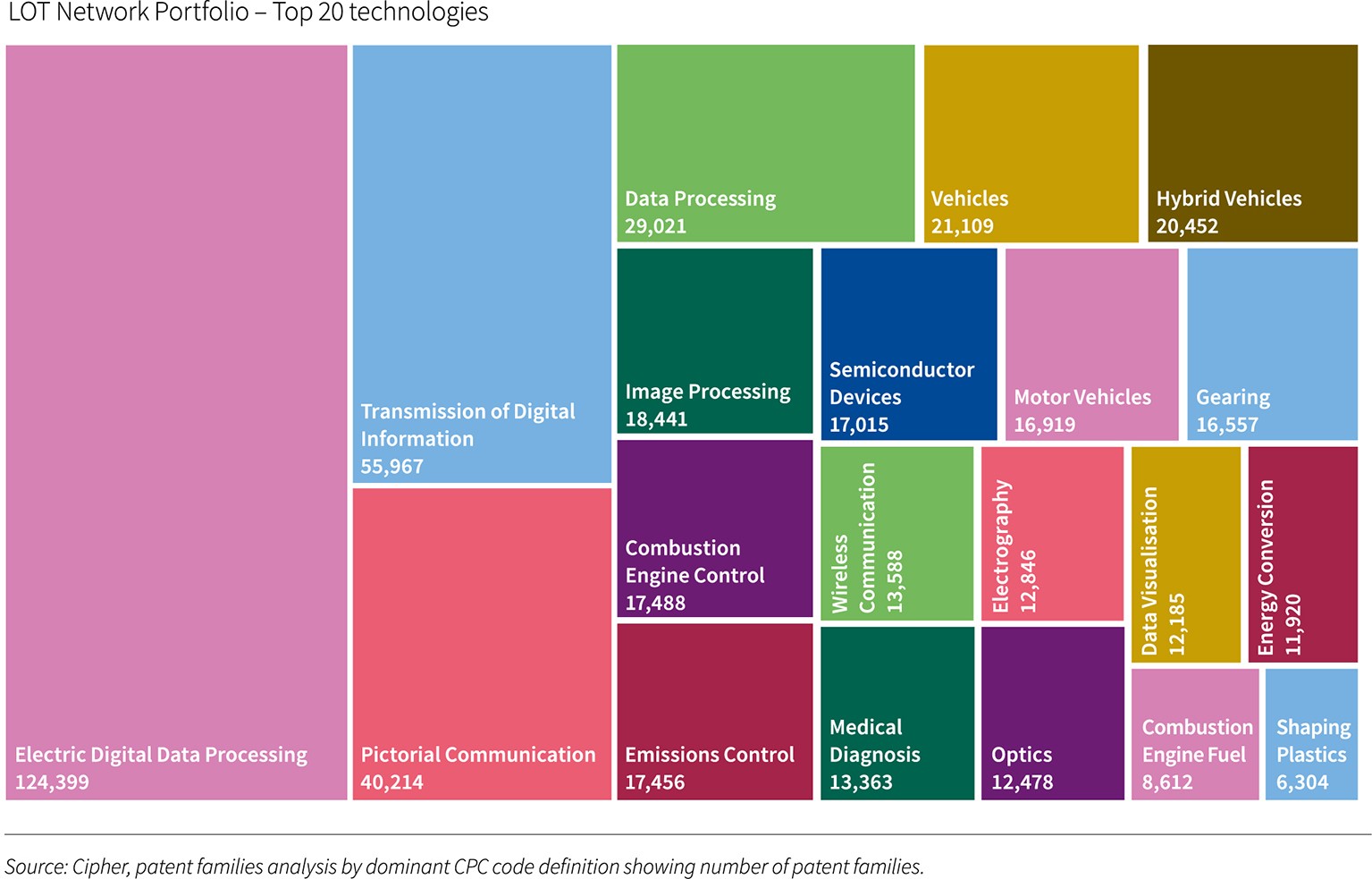

Chart 5 is also from LOT Network Report 2020 and it shows LOT Network Portfolio in the top 20 technologies. The LOT Network Portfolio covers a very broad range of technologies which include the key technology areas that are common areas for PAE litigation, such as Electric Digital Data Processing, Transmission of Digital Information, Data Processing and Image Processing, etc.

Chart 5

LOT Network has members from 36 different countries and every part of the high-tech industry. Because of the diversity and size of its members, the combined LOT Network portfolio has both good region and technology coverage. Furthermore, its portfolio quality can be illustrated by the sophistication of it high-tech members, such as industry leaders like Toyota, Microsoft, Google, IBM, Tesla, Alibaba, and Tencent, etc. So far, at least six transfers of assets from a LOT member to a PAE have been identified. Those in LOT received a free license in accordance with the license in accordance with the license agreement including the approximately thirty Chinese companies that have joined LOT. Those Chinese companies that have not yet joined LOT Network may be at risk of being sued.

Chinese companies are working hard to provide good products and services to the world while making profits; however, PAEs are aiming at taking as much as possible away from their profits. We would like to remind Chinese companies to prepare early to protect their hard work results from PAEs’ increasing threat.

Author Biography

Hao-Chin (Frank) Jeng is the Chief International Marketing and Development Office and Vice President of Purplevine IP Group who manages and counsels on more than 50 global patent litigations and licensing negotiations for China-based clients. As an attorney admitted in the U.S. and Hong Kong, Frank specializes in international dispute resolution, including IP litigation, commercial litigation and white-collar investigation, and cross-border transactions, including M&As, IPOs and IP licensing. Prior to joining Purplevine, Frank was a partner of Kirkland & Ellis. He can be reached at frank.jeng@purplevineip.com.

Dan Shang is the Licensing Director of Purplevine IP Group and responsible for introducing LOT Network to China-based clients. She focuses on patent licensing negotiation. Her patent licensing negotiation experience emphasizes non-infringement and invalidity analysis of exemplary patents, license business solution design, as well as license agreement review. She also helps Chinese companies to join LOT Network in Chinese Mainland. Ms. Dan Shang is a certified patent attorney and a certified lawyer in China. She can be reached at dan.shang@purplevineip.com.